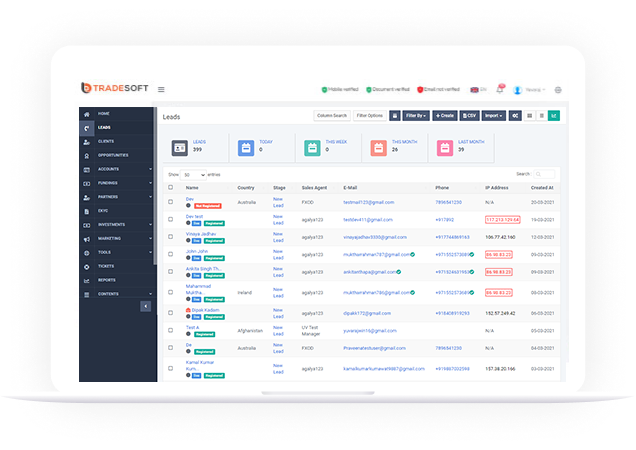

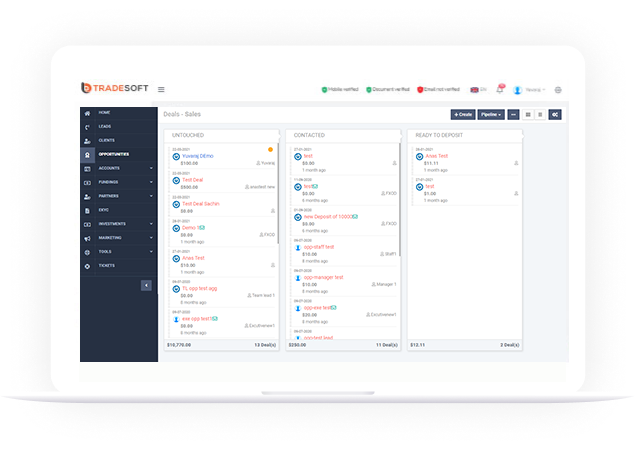

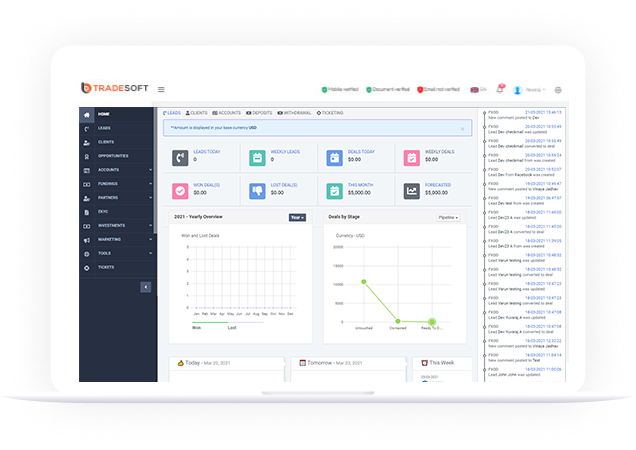

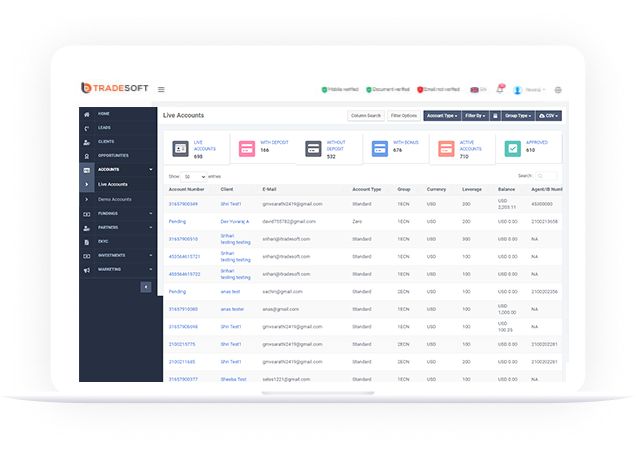

Business CRM

Web Trader

Social Trading

Crypto Exchange

Top-ranked traders would be recommended to users. Users can set up their own discussion groups to widen their investment circles with friends.

Social traders can make market forecast based on the direction or target price. Thus, the system would then gather and calculate the forecast of each user to create the user ranking

One can freely express their views and create their settings of paid articles and strategies. Thus, increasing their popularity and earnings.

Charts of product price ranges are created based on clients' trading data to analyze the bull and bear power, so as to improve trading strategy from different perspectives as a whole.

Users can get rewards by providing the best answers to others' investment questions, but also can gain from asking valuable questions by sharing confidential answers to interested parties

Real-time quotes of various products and real-time financial information are provided. Users can set up their own watchlist according to their portfolios, so as to get the market trends anytime anywhere

With our user-friendly SKOD social trading platform good traders can become signal providers and show their trading statistics in leaderboard. Those who like it can subscribe to signals and copy every new position.

Your clients can use an account nominated in any currency. The platform supports any combination imaginable. All fees will be calculated and paid respectively. Accounts can be opened in fiat and cryptos: USD, JPY, BTC, USDT, EUR, etc.

Our platform provides all the basic and advanced functions for these types of products:

Open positions

Close positions

Stop following immediately

Your clients can be placed in different groups with different symbol names for one instrument where you can set different price streams and other symbol settings as a whole:

With the increasing competition in the Business CRM market, introducing a new service like SKOD social trading will open new markets for your company and bring in new clients

By diversifying your product line with new social trading platform, you can attract a new type of client and potentially increase business revenue

A new investor can learn from the best traders and directly copy the trade from them, which help move potential clients from demo accounts to live ones

Investors may optimize their trading portfolio with a variety of copy modes, resulting in higher trading activity and trading volumes

By displaying traders’ trading performance on your platform, you will be able to increase your brokerage transparency and gain more client’s trust

Some of the other features of social trading platforms are as follows

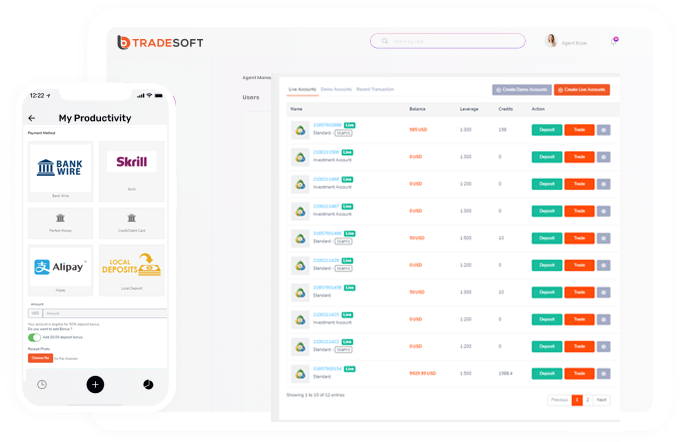

Your clients can trade Business CRM and all other groups of instruments on offer.

The clients will receive an email with login details and a password every time a new account is created.

A signal provider and his followers are able to have different account currencies, including cryptos.

Trading Accounts can be nominated in any fiat or crypto-currency such as BTC, ETH, Ripple and others.

There is a table in settings where you can specify in which group the account type that should be opened by default. Also, the platform can copy a group from a payment account.

Each client action, data from the MT server or calculation is logged by a platform. When you have a query about why something may have happened, it can be found in the log files.

It is hard to manage risks between A- and B-books if the slave is subscribed to 3 or 5 masters. You can limit the number of active subscriptions for 1 slave.

You can specify a range for new master and slave accounts which are opened by a platform individually, e.g., new slaves will be opened in 100000-200000 and new masters in 400000-500000 ranges.

You can allow clients to open as many accounts as they want or just 5-7, for example.

You can limit the number of active subscriptions for 1 master and make his offer limited for new investors.

Almost all functions are customizable in a few clicks from the admin panel.

Your clients can trade manually or with EAs with no limitations regarding trading style or instruments.

The money manager can share fees between himself and his agents for a specific investor, or all of them.

White label architecture is the same as for WLs in the MetaTrader server. Each WL has access to their account via the manager's applications.

The system can automatically archive inactive accounts after they are deleted or archived in the MT4 and MT5 server.